1 The Principal Director General or Director General or Princi- pal Chief Commissioner or Chief Commissioner or Principal Commissioner or. Income Tax Act 2007 Section 127 is up to date with all changes known to be in force on or before 17 February 2022.

Bookkeeping For Construction Companies Company Finance Bookkeeping Construction Company

Section 127 Income-tax Act 1961.

. Section 97 Submission of income return not required. Scope of exemption granted under Section 127 The clarification addresses the common interpretation issue when a non-. Power to transfer cases.

General management and administration. 1271 The Revenue Commissioners shall make regulations with respect to the assessment charge collection and recovery of income tax in respect of emoluments to which this Chapter applies or tax for any previous year of assessment remaining unpaid and those regulations may in particular and without prejudice to the generality of the foregoing include. B 6 23 of the taxpayers income for.

Section 127 of the Income Tax Act 1967 ITA is included in the mutual exclusion list of a gazette order the taxpayer therefore cannot make a claim for the incentive offered in the said gazette order. Congress passed the American Taxpayer Relief Act of 2012 HR. The expansion of Section 127 allows employers to make payments for student loans without the employee incurring taxable income and the payment is a deductible expense for the employer resulting in tax advantages to both parties.

Section 127. By these Special Civil Applications the writ-petitioners have challenged the order dated July 29 2011 passed by the Commissioner of Income Tax Valsad transferring the cases of the petitioners in exercise of power conferred under sub-section 2 of Section 127 of the Income Tax Act 1961. A benefit an employer provides on behalf of an employee is taxable to the employee even if.

For example education expenses up to 5250 may be excluded from tax under IRC Section 127. 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after. Section 127 of the Income Tax Act 1961 Act for short deals with the power of competent officers to transfer cases.

Changes that have been made appear in the content and are referenced with annotations. Section 1274 of Income Tax Act. Which allows an employee to exclude from income up to 5250 per year in.

Section 91 Tax withholding certificate. Cases pertaining to survey us 133A of the Income-tax Act1961Act. 99514 to which such amendment relates see section 1019a of Pub.

Section 96 Income return. Section 93 Adjustment facility and inclusion of tax not to be withheld finally. Transfer Order passed under Section 127 of the Income Tax Act 1961 is more in the nature of an administrative order rather than quasi-judicial order and the Assessee cannot have any right to choose his Assessing Authority as no prejudice can be said to have been caused to the Assessee depending upon which Authority of the Department passes.

Section 92 Payment from which tax is withheld finally. Originally the CARES Act was a temporary measure allowing tax-free principal or interest payments made between. Power to transfer cases 1 The Principal Director General or Director General or Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter wherever it is possible to do so and after recording.

Section 94 Payment of tax in installment. CBDT Notification No. Section 127 Tax-Free Education Benefits at Risk.

127 1 The Director General or Chief Commissioner or Commissioner may after giving the assessee a reasonable opportunity of being heard in the matter. 127 1 There may be deducted from the tax otherwise payable by a taxpayer under this Part for a taxation year an amount equal to the lesser of. This is incentives such as exemptions under the provision of paragraph 1273b or subsection 127 3A of ITA 1976 which is claimable as per government gazette.

100647 effective except as otherwise provided as if included in the provision of the Tax Reform Act of 1986 Pub. Amendment by section 1011Ba31B of Pub. INCOME TAX SLAB RATES FOR FY.

Who shall ensure that such cases are transferred to Central Charges us 127 of the Act within 15 days of service of notice us 1432. Section 95 Return of estimated tax to be paid. The income tax exemption under section 127Under IA the quantum of allowance.

In the same page there is an item called Entitled to claim incentive under section 127 which refers to claiming incentives under section 127 of the Income Tax Act ITA 1976. 23-8-2001 - U Section 120 of the Income-tax Act 1961 Jurisdiction of Income tax authorities. 20-8-1999 - Central Board of Direct Taxes directs that the Commissioner of Income-tax Central Patna have jurisdiction over all such cases or classes of cases as may be assigned to him us 12012.

Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Section 127 of the Income Tax Act. Power to transfer cases.

The said section reads as follows. There are changes that may be brought into force at a future date. 1271 For the purposes of sub-section 1 of section 282 the addresses including the address for electronic mail or electronic mail message to which a notice or summons or requisition or order or any other communication under the Act hereafter in this rule referred to as communication may be delivered or transmitted shall be as per sub.

Cases where registrationapproval under various sections of the Act such as section 12A 351ii iia iii 1023C etc. Amounts for additional education expenses exceeding 5250 may be excluded from tax under IRC Section 132d. More than one IRC section may apply to the same benefit.

CHAPTER XIII - Income-tax Authorities. A 23 of any logging tax paid by the taxpayer to the government of a province in respect of income for the year from logging operations in the province and. The transfer of a case under sub-section 1 or sub-section 2 may be made at any stage of the proceedings and shall not render necessary the re-issue of any notice already issued by the Assessing Officer or Assessing Officers from whom the case is transferred.

283E-In exercise of the powers conferred by clause d and clause e of proviso to clause 5 of section 43 and section 282A read with section 295 of the Income-tax Act 1961 43 of 1961 the Central Board of Direct Taxes hereby makes the following rules further to amend the Income-tax Rules 1962 namely-.

Businessleaderss Shared A Photo On Instagram Remember Just Because They Follow You Doesn T Mean They Support You Finanzen Geschaftsplane Bildung

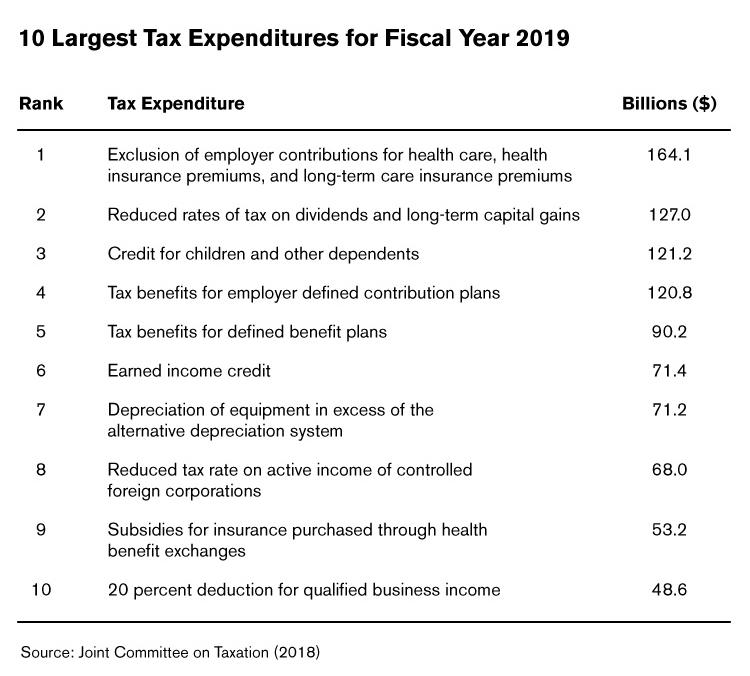

What Are Tax Expenditures And Loopholes

Income Tax Income Tax Tax Rules Tax Credits

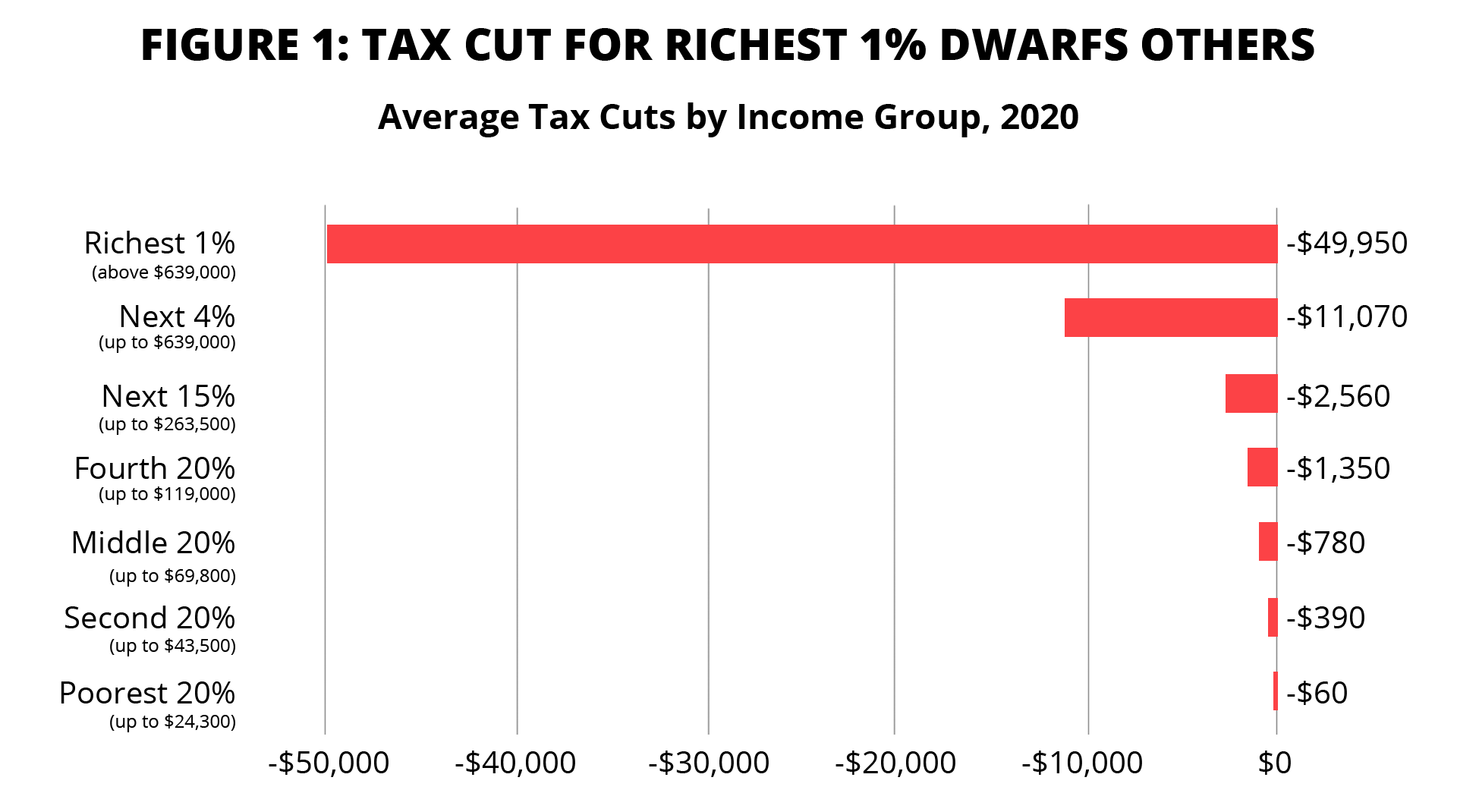

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

Pin By The Taxtalk On Income Tax In 2021 Income Tax Taxact Income

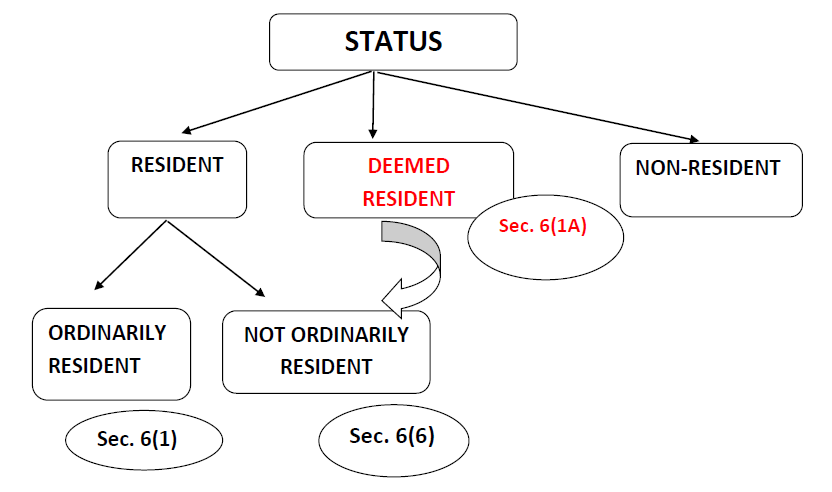

Nri Status For Financial Year 2020 21 New Circulars Sbnri

Irs To Reinstate Form 1099 Nec Requests Comments On Draft Apasnc Irs Teacher Resume Examples Irs Forms

Solution For Dsc Trouble Shooting On Gst Website Https Taxguru In Goods And Service Tax Solution Dsc Trouble S Solutions Goods And Service Tax Indirect Tax

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

The Promise It Will Be A Middle Class Tax Cut Americans For Tax Fairness

Preparing Tax Returns For Inmates The Cpa Journal

2021 Salary Guide Pay Forecasts For Marketing Advertising And Pr Positions Salary Guide Positivity Advertising

No Dissolution Clause In The Trust Deed Whether Registration U S 12ab Can Be Denied The Proposition Taxact Clause

No Tax On Housewives Who Deposited Less Than Rs 2 50 Lakhs Cash During Demonetization Agra Itat Tax Income Tax Taxact

Turn Your Tax Refund Into A Nest Egg Tax Refund Online Business Tools Infographic

Tax Law Changes 2021 Loss Limitation Rules Becker

New York Issues Guidance On How To Report The Decoupling From The Cares Act On The Personal Income On Tax Forms It 201 It 203 It 204 And It 205

No Withholding Tax On Commission Paid To Agents Outside India For Procuring Orders Agra Itat Taxact Tax The Outsiders